If you’ve recently filed your tax return and are eagerly anticipating a refund, it’s natural to wonder when you’ll receive it. This article provides an estimated tax refund schedule and offers key details about the refund process.

Qualifying for a Tax Refund:

A tax refund is granted to individuals when the total amount of payments they’ve made (including income tax withheld from their wages or estimated payments made throughout the year) and any refundable tax credits they claim exceed the calculated tax based on their taxable income for the year.

Timeline for Receiving a Tax Refund:

1. Electronically filed returns with direct deposit:

If you opt for direct deposit of your federal refund into your bank account and file your return electronically, you can typically expect the refund to be deposited within 21 days from the IRS’s acceptance of your electronic return. For an estimate of when you might receive your tax refund, refer to the tax refund schedule calendar provided below.

2. Paper filed returns with direct deposit:

If you choose direct deposit for your federal refund and file a paper return, it generally takes around 21 days from the time the IRS receives your paper return for the refund to be deposited. The tax refund schedule calendar can give you an estimate of when you might receive your tax refund.

3. Tax refunds via check:

If you request a refund by check, please note that it usually takes a minimum of 6 to 8 weeks for the refund to be mailed to the address you provided on your federal return. Refer to the tax refund schedule calendar for an estimate of when you might receive your tax refund check.

Checking the Status of Your Refund:

To keep track of your refund, you can use the “Where’s My Refund?” tool on the IRS website. It provides real-time information about the status of your refund.

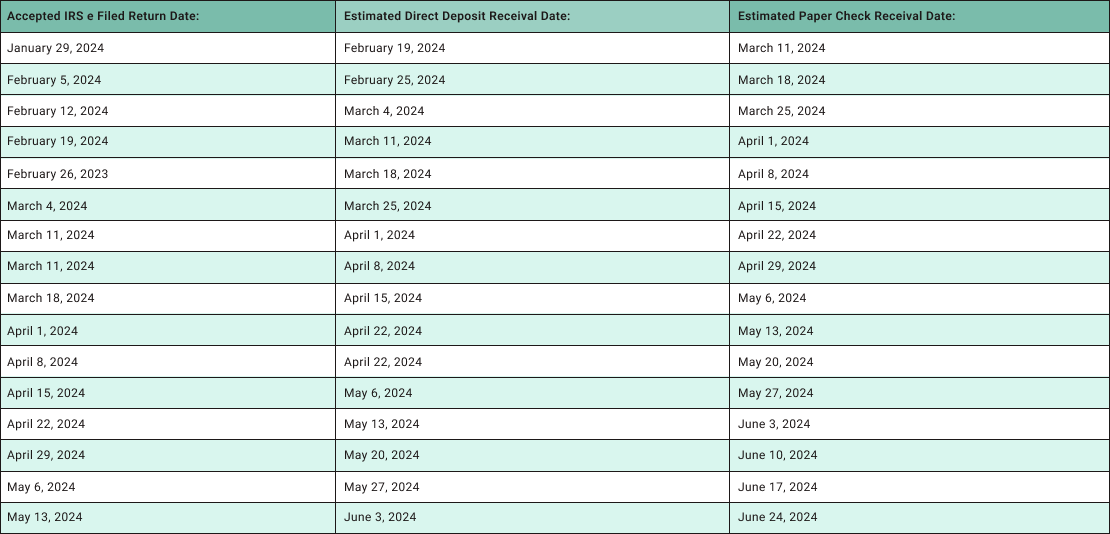

Tax Refund Calendar:

The following tax refund schedule is an estimate based on the approximate distribution times for direct deposit and paper checks by the IRS. Remember that for federal tax returns filed early in the filing season and claiming the Earned Income Tax Credit (EITC) and/or the Additional Child Tax Credit, the IRS cannot issue a refund until mid-February.

Accepted IRS eFiled Return Date:

Reasons for Delayed Refunds:

There are various reasons why an individual’s federal refund may be delayed, such as errors, incomplete returns, the need for special processing, or if the return is affected by identity theft or fraud. For early-filed federal returns claiming the Earned Income Tax Credit and/or the Additional Child Tax Credit, the IRS cannot issue a refund until mid-February. You can use the “Where’s My Refund?” tool on the IRS website to check the status of your refund.

State and Federal Refunds:

The time it takes to receive a state tax refund varies across states. Due to concerns about fraudulent returns and identity theft, most states do not provide estimated timelines for state income tax refund issuance. For information on when you can expect to receive your state income tax refund, it’s recommended to visit your State Department of Revenue’s website.

In summary, the timeline for receiving a federal tax refund depends on whether you filed electronically or by paper and whether you chose direct deposit or a check. Utilize the IRS’s “Where’s My Refund?” tool to monitor the status of your refund. State tax refund timelines differ by state, so it’s advisable to consult your respective State Department of Revenue website for more details.